Morses Club Loan Compensation, What's it All About?

When borrowers are mis-sold loans, it can often put them in a worse financial position to what they were in prior to the loan. If you were sold a loan you can’t properly afford, you could be eligible for a refund. Forces Compare can help you start your claim for a mis-sold loan.

We can help you make claims on mis-sold loans from a range of different lenders, including Car Cash Point, Cash ASAP, Cash 4 U and more. This page focuses on how to make a claim on mis-sold loans from Morses Club.

Click on the “Start Your Claim” button, where you’ll be taken to our online form. This form is free to submit and takes only a few minutes to complete. Once complete, you should hear back regarding your submission in just a couple of weeks.

“According to FOS statistics published in March 2021, Guarantor loans in particular were shown to have been upholding a huge 83% unaffordability complaints.”

Your Claim Is In Good Hands

Since their conception in 2013, Allegiant Financial Services Ltd have clawed back over £5om in financial misselling claims.

Why Would I Be Given a Morses Club Loan Refund?

If you have taken out a loan with Morses Club, and one or several of the following statements applies to your circumstances you may be entitled to compensation.

- During your application process, you may not have mentioned all of your debts and if this didn’t match with your credit record, the lender should have ensured to reaffirm this.

- It is possible that you underestimated your monthly expenditure due to guesswork or eagerness to be eligible for your loan, and in such circumstances, if your figures appeared too low, your lender should have explored their reliability further.

- At the time of your application did you have a regular income? If you were self-employed during this period or even had overtime that fluctuated, the lender should have looked at this.

- Did you have evidence of recent applications for credit or previous problems on your credit record? The lender should have been conscious of whether your situation appeared to be worsening.

- Whenever you topped up an existing loan, your lender should have ensured to run another set of checks concerning whether this was affordable. Had you missed any previous loan repayments? Had your finances deteriorated since your first loan? If so, the lender should have addressed the fact that their current loan could be unaffordable and as a result, capped any more lending.

Mis-Sold a Loan From Morses Club?

Think you’ve been mis-sold a loan from Morses Club? If you were sold a Morses Club loan you couldn’t properly afford, you could be eligible for a refund.

- If a loan puts you in a worse financial position than what you were in before borrowing it, it should never have been granted in the first place. This is the case even if you really needed to borrow the money.

- Financial pressure on the loan could’ve also worsened if you were given top-ups or extensions on a pre-existing loan that hadn’t undergone proper checks for affordability.

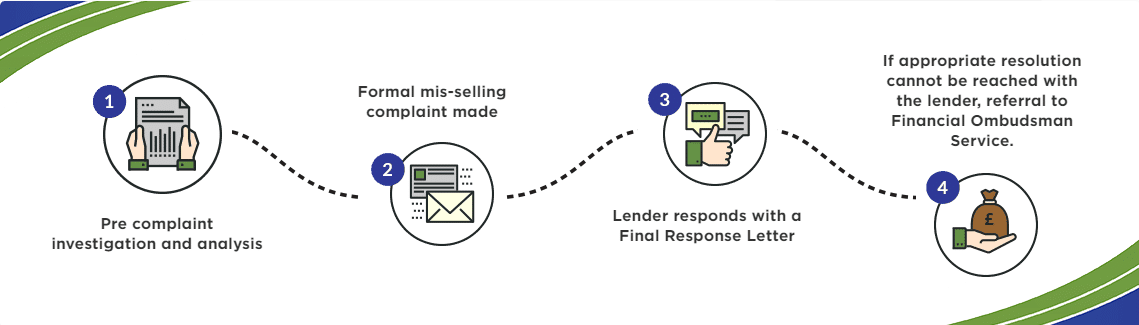

Making a Claim: How Does it Work?