Mis-Sold Savvy Loans - How Does it Work?

If you have struggled to repay a Savvy loan in the last few years, you could be eligible for some compensation and a significant refund.

Thousands of borrowers across the UK have been granted loans in the last few years that they simply cannot afford.

Although lenders try to carry out sufficient checks, this is not always the case and some people are still granted loans despite being on benefits, unemployed or already under mountains of debt.

If you had trouble repaying your loan on-time and subsequently paid additional fees or took on additional loans, you could be eligible for a fully Savvy loan refund, including the full loan amount, interest and compensation on top.

At Forces Compare, we have partnered with the very established Allegiant Finance Services who will package up your claim and fast-track it so you can receive a quick and effective resolution for your claim.

Our entire claims process is completely free to submit and only takes a few minutes to do online. Some customers have been able to recover hundreds of thousands of pounds so far.

We operate a no-win, no fee basis, but with a fast turnaround you should receive a decision within a matter of weeks.

DID YOU KNOW:

You could receive hundreds or thousands of pounds in compensation if you struggled to repay your loan. Not every loan is eligible for a refund, but if you could not afford the loan at the time, received a top up, rollover or extension, these have a particularly high-uphold rate. You can submit your claim in less than 5 minutes below:

We Are Working With Allegiant Finance Services

Forces Compare has proudly partnered with Allegiant Finance Services to help submit your Savvy Loan reclaim. Allegiant are one of the most successful claims companies in the sector and have been trading since 2013. They have successfully recovered more than £50 million worth of mis-sold claims for their customers to date and have an excellent track record.

Am I Eligible for Savvy Loan Compensation?

If you have taken out a Savvy Loan (either payday or short term loan) and one or several of the following statements applies to your circumstances you may be entitled to compensation.

- During your application process, you may not have mentioned all of your debts and If this didn’t match with your credit record, the lender should have ensured to reaffirm this.

- It is possible that you underestimated your monthly expenditure due to guesswork or eagerness to be eligible for your payday or short term loan, and in such circumstances, if your figures appeared too low, your lender should have explored their reliability further.

- At the time of your application did you have a regular income? If you were self-employed during this period or even had overtime that fluctuated, the lender should have looked at this.

- Did you have evidence of recent applications for credit or previous problems on your credit record? Short term loans should not always be targeted at students and the lender should have been conscious of whether your situation was getting better or worse.

- Whenever you topped up an existing Savvy Loan, your lender should have ensured to run another set of checks concerning whether this was affordable. Had you missed any previous loan repayments? Had your finances deteriorated since your first loan? If so, the lender should have addressed the fact that their current loan could be unaffordable and as a result, capped any more lending.

- The firm may only have carried out a brief affordability check on you because of your circumstances. Regardless of your financial status, the loan needed to reflect your personal repayment potential.

Have You Been Mis-Sold a Savvy Loan?

You could have been mis-sold a Savvy Loan if you were unable to keep up with repayments. All lenders should carry out sufficient checks to ensure that customers can repay on-time. If you were ever offered an extension, top-up, rollover or extra loan, this should have undergone the same initial checks – and if this worsened your financial situation, you may be eligible for a Savvy Loan claim.

To check your eligibility, simply click on ‘Start Your Claim’ using the button provided. We require you to fill in a few basic details online and this will submit your claim for free through our partners at Allegiant.

With a quick resolution time, you will usually hear back within a matter of weeks and you could be owed a large compensation sum.

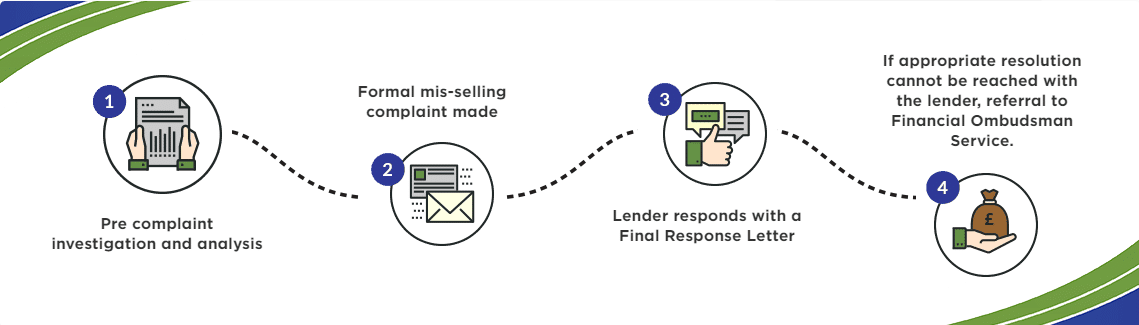

How The Process Works